Bond Market Signals 50-Bps Bank of Canada Rate Cut Following Disappointing Jobs Report

Source: Oxford Economics/Haver Analytics

Canada’s Rising Unemployment Rate Sparks Bank of Canada Rate Cut Speculation

Introduction

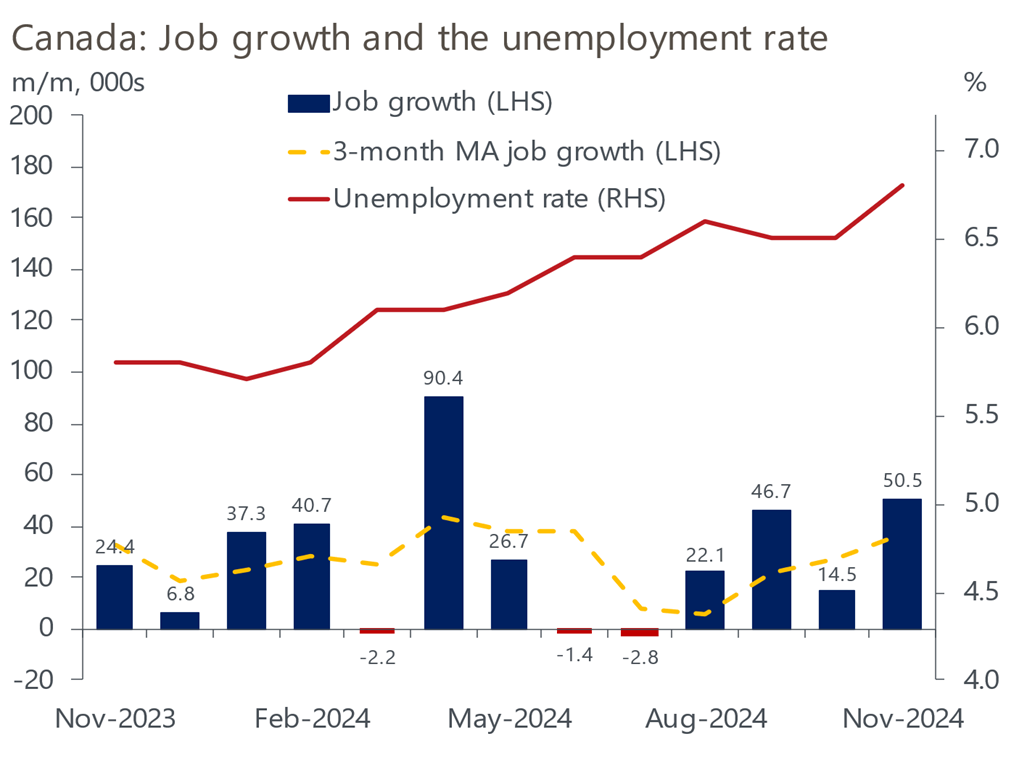

Canada’s unemployment rate has hit a concerning milestone, climbing to 6.8% in November—its highest level outside of the pandemic years since 2016. This unexpected rise is now being closely watched by the Bank of Canada (BoC) as a key factor in upcoming interest rate decisions. With labour market slack, modest GDP growth, and inflation steady at 2%, many economists are forecasting a significant rate cut at the BoC’s next meeting.

Unemployment Rate Surges

According to Statistics Canada, the 6.8% unemployment rate reflects a 0.3 percentage point increase from October and is 0.2 percentage points higher than projected. While the economy added 50,000 new jobs in November, this wasn’t enough to match the rapid rise in the labour force, with 138,000 Canadians actively seeking work.

BMO’s Chief Economist Douglas Porter called this unemployment data a potential stressor for the Bank of Canada. “If there is one indicator that will stress the Bank of Canada, this would be the one,” he stated.

The report shows a mixed bag of job sector growth, with gains in wholesale/retail trade (+39,000), construction (+18,000), and professional services (+17,000). However, job losses were seen in manufacturing (-29,000), transportation/warehousing (-19,000), and natural resources (-6,300).

Rate Cut Forecasts Intensify

In response to the labour market’s growing slack, economists at BMO and Oxford Economics now expect a 50-basis-point rate cut at the BoC’s December 11 meeting. If this materializes, it would lower the policy rate to 3.25%, the lowest since September 2022. Variable-rate mortgage holders and those with home equity lines of credit (HELOCs) would benefit from reduced borrowing costs as the prime rate drops to 5.45%.

Bond markets are pricing in a 75% chance of a 50-basis-point rate cut, while Desjardins forecasts a smaller 25-basis-point cut. Desjardins Senior Director of Canadian Economics, Randall Bartlett, argues that the rise in unemployment “masks the strength under the hood” of the Canadian economy. Desjardins points to robust hiring in November, steady GDP growth, and inflation remaining at or below 2% as reasons for a more measured approach.

Labour Market Trends and Regional Shifts

While the headline unemployment rate is cause for concern, the underlying numbers tell a more nuanced story. Total hours worked were nearly unchanged from October but up 1.9% year-over-year. Additionally, 54,200 full-time jobs were added, while part-time jobs saw a small decline of 3,600.

Regionally, Alberta (+24,000), Quebec (+22,000), and Manitoba (+6,600) saw the largest employment gains, while other provinces experienced little to no change.

On a demographic level, youth unemployment saw a sharp increase of 1.1 percentage points to 13.9%, and long-term unemployment (those jobless for 27 weeks or more) rose to 21.7% of total unemployed, marking a 5.9 percentage point increase compared to last year.

What’s Next for the Bank of Canada?

All eyes are on the BoC’s next policy announcement on December 11. While the most likely scenario points to a 50-basis-point rate cut, there remains the possibility of a more modest 25-basis-point reduction. Key factors influencing the Bank’s decision include:

Labour Market Conditions: Rising unemployment and slowing job growth are pushing the BoC to ease rates.

Inflation Stability: With inflation tracking at 2%, the Bank has room to cut rates without risking price instability.

Currency Weakness: The Canadian dollar is approaching a 20-year low, a factor that could influence the Bank to act more cautiously.

Conclusion

The unexpected rise in Canada’s unemployment rate is prompting serious consideration of an interest rate cut by the Bank of Canada. While BMO and Oxford Economics see a 50-basis-point cut as the most probable outcome, Desjardins suggests a 25-basis-point cut is more prudent. Regardless of the final decision, the BoC’s next move will have a significant impact on mortgage holders, borrowers, and the broader economy.

Each Office is Independently Owned & Operated • Brokerage 13072 | © Copyright 2024 . All Rights Reserved