Canada’s Economy Is Slowing – Will the BoC cut Interest Rates Soon?

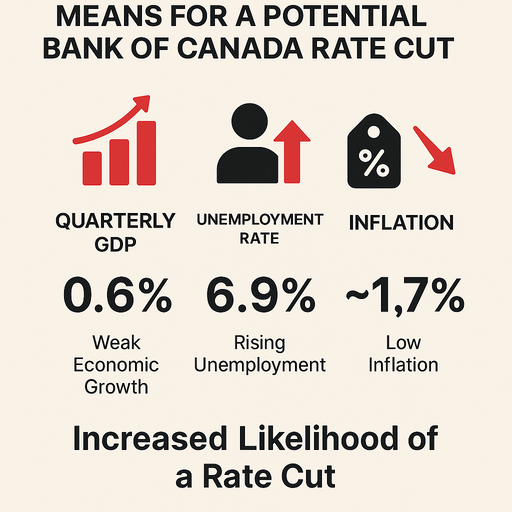

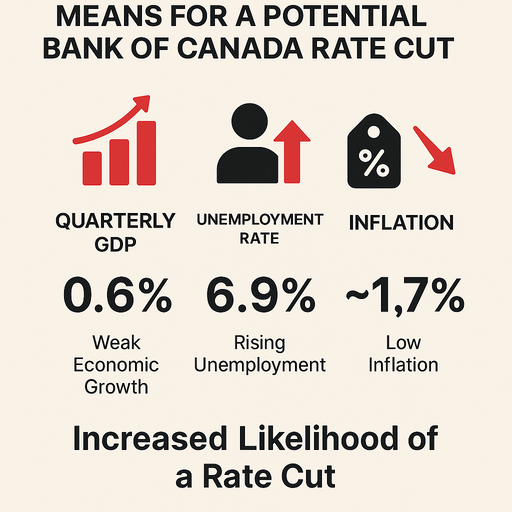

What That Means for a Rate Cut Decision

GDP growth: 0.6% (real, weak)

Unemployment: 6.9% (real, elevated)

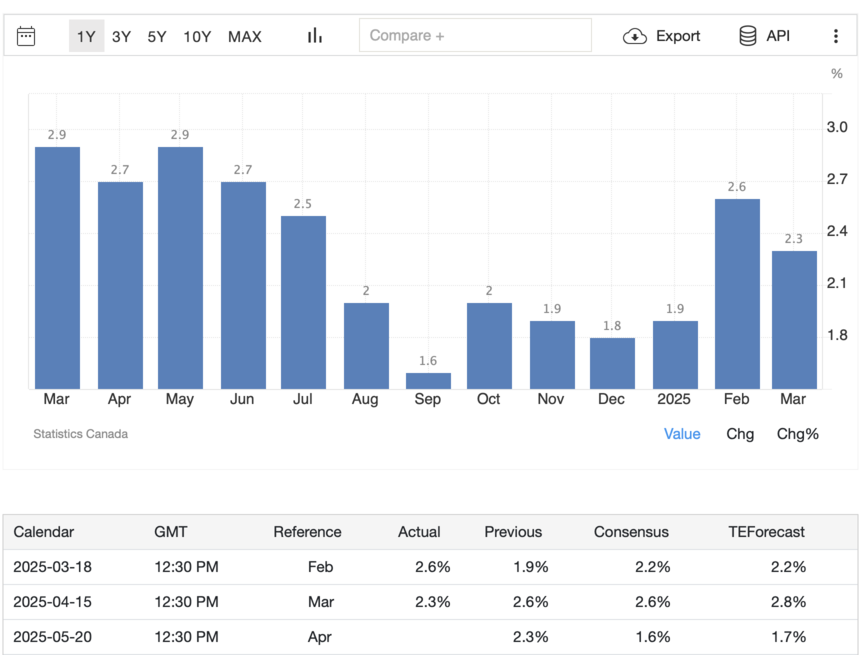

Inflation: Forecasted at 1.7% — not confirmed

1. The BoC Will Likely Be More Cautious

If inflation hasn’t yet dropped below target, the BoC will be hesitant to cut too aggressively.

Forecasts can be wrong — they depend on models and assumptions, which may not fully capture sticky prices or supply-side risks.

2. They’ll Wait for Confirmation

The BoC typically needs real evidence of easing inflation before cutting.

It may delay the first rate cut or opt for a small, symbolic move (e.g. 25 bps) while waiting for actual CPI prints.

3. Forward Guidance Will Be Key

The BoC might signal dovish intentions and set the stage for cuts if inflation data aligns with forecasts.

Markets could react as if a cut is coming soon, even if it’s not immediate.

A Reasonable Rate Cut Estimate: 25 to 50 basis points (0.25%–0.50%)

🔹 25 bps (0.25%) cut — baseline scenario

Likely the BoC’s first move if this is the initial response to softening data.

This would signal a shift toward easing without overreacting.

It preserves flexibility for future cuts if needed.

🔹 50 bps (0.50%) cut — if economic deterioration is more rapid

Justified if unemployment rises quickly or GDP contracts.

This would be a stronger stimulus, especially if the BoC wants to pre-empt a recession.

Historically used when central banks are trying to shock markets back to life or restore confidence.

Why Not More (like 75 or 100 bps)?

Inflation is still close to target — not low enough to justify a deep emergency-style cut.

The BoC may want to keep some powder dry in case conditions worsen further.

Financial stability risks (e.g., reigniting excessive borrowing) still matter.

Ready to Renew your mortgage? Let’s Talk.

Contact us today to discuss how you can take advantage of current market conditions and renew your mortgage with confidence—and potentially at a much lower rate.

Each Office is Independently Owned & Operated • Brokerage 13072 | © Copyright 2024 . All Rights Reserved