Canadian Inflation Eases While U.S. Fed Eyes 25 bps Rate Cut

Canada’s inflation is cooling down, with November’s Consumer Price Index (CPI) growth expected to hit 1.9%, a sign of progress toward the Bank of Canada’s 2% target. Meanwhile, south of the border, the U.S. Federal Reserve is preparing for a 25 basis point rate cut, signaling a shift in monetary policy. Here’s a closer look at how these changes could impact you.

1️⃣ Inflation Trends in Canada

The Canadian economy is showing signs of relief as inflation eases to 1.9% in November, down from previous months. Here’s a closer breakdown:

Food Inflation: Remains steady at 3% year-over-year.

Energy Inflation: Decreased to -2.7%, driven by lower energy costs.

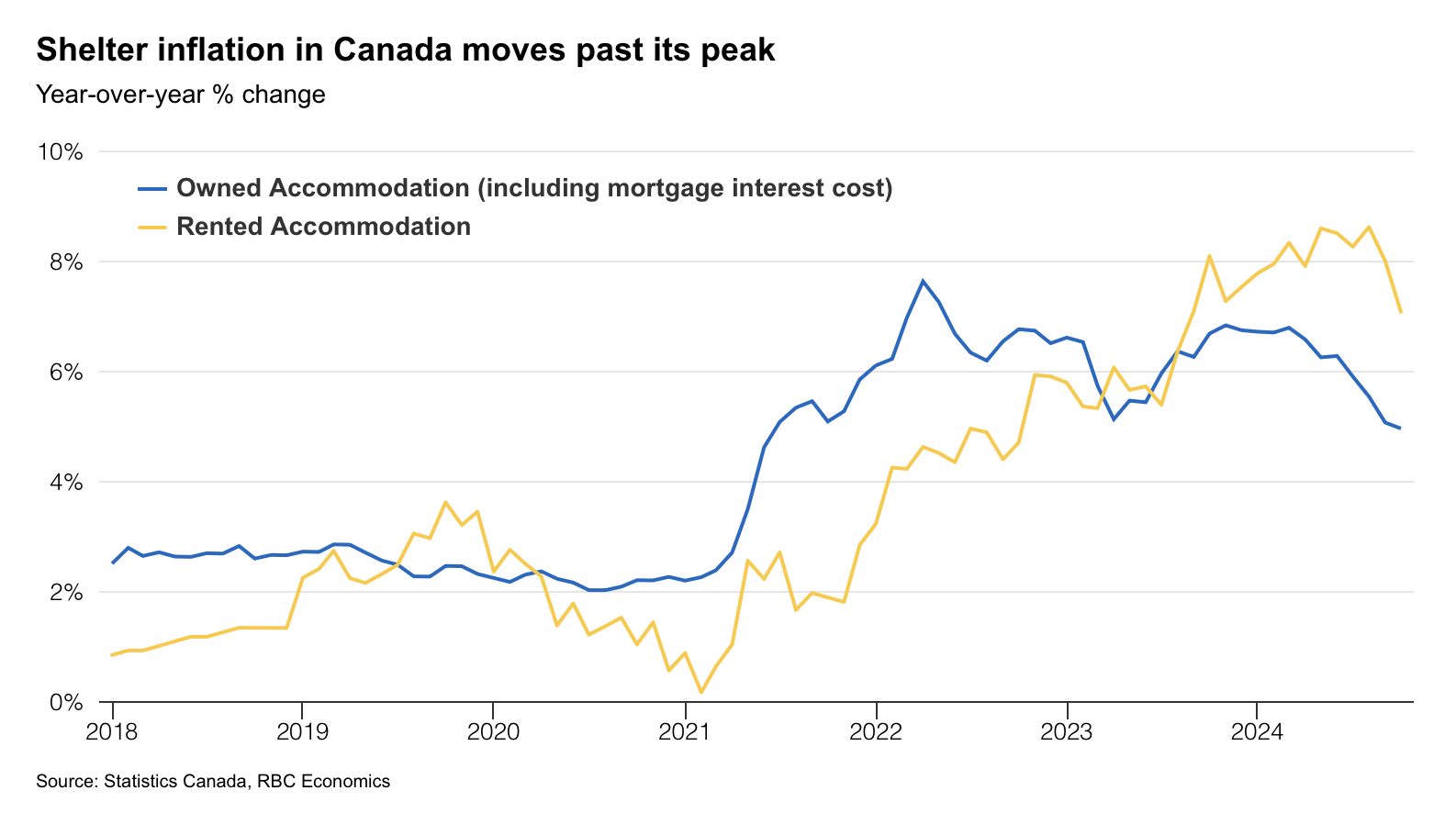

Shelter Costs: Mortgage interest costs are still up 15% YoY, but this is down from the 30% peak in 2023. Rent inflation is also slowing as lease renewals reflect current market rates.

The Bank of Canada’s “core” inflation measures are also cooling, with CPI trim and median expected to average 2.5%, down from a recent spike.

What it means for you: Lower inflation can ease pressure on household budgets, especially in rent and mortgage payments. With energy prices also cooling, utility bills could see relief.

2️⃣ U.S. Federal Reserve to Cut Interest Rates

Unlike Canada, where inflation is easing, U.S. inflation remains sticky at 2.7%, with the Fed’s “supercore” measure holding steady at 4.3%. However, signs of a slowing labor market and lower inflation compared to early 2024 have prompted the U.S. Federal Reserve to prepare a 25 bps rate cut.

Fed Chair Jerome Powell hinted that rate cuts will be gradual, but expectations are high for back-to-back cuts in December and January, lowering the fed funds rate to a range of 4%-4.25%.

What it means for you: Lower U.S. rates could ease borrowing costs globally, affecting variable-rate mortgages and credit lines in Canada. If you have USD-linked investments, these shifts could impact your returns.

3️⃣ Key Takeaways

Canadian inflation cools to 1.9%, offering relief to households.

U.S. Fed plans to cut rates by 25 bps in December and January, lowering rates to a range of 4%-4.25%.

Mortgage rates and consumer borrowing costs may decline as inflation pressure eases.

With these changes, it’s crucial to keep an eye on mortgage interest costs, rent adjustments, and potential impacts on consumer borrowing.

Want to stay updated on inflation, interest rates, and what it means for your finances? Follow us for expert insights and timely updates!

#InflationUpdate #RateCut #EconomicTrends #InterestRates #USFed #CanadaEconomy #MortgageNews #MoneyMatters #PersonalFinance #FinanceTips #SmartInvesting #FinanceNews

Each Office is Independently Owned & Operated • Brokerage 13072 | © Copyright 2024 . All Rights Reserved