Economic Update Matters If You’re Looking for a Lower Mortgage Rate

Slowing economic activity in Canada, with GDP shrinking by 0.1% in April and early signs suggesting another decline in May. Here’s how that connects to mortgage rates:

1. Lower Growth = More Room for Rate Cuts

The Bank of Canada closely watches GDP as a signal of economic health. A slowdown gives the BoC more incentive to cut interest rates—which can translate into lower mortgage rates for you.

2. Market Already Pricing in a Rate Drop

Bond yields have already dipped in response to the weaker data. That’s important because mortgage rates often follow bond yields. If you’re considering a refinance, switch, or new mortgage, this could be your window.

3. BoC Could Cut Rates Again—Possibly in July

With economists now forecasting two more rate cuts this year, mortgage holders may see even better offers(Lower Mortgage Rate) in the coming months. But waiting too long could be risky if inflation surprises to the upside.

What You Can Do Now:

Get Pre-Approved: Lock in today’s rate before further changes.

Compare Lenders: Not all lenders pass on savings equally. Use the slowdown as leverage.

Refinance Smart: If your current mortgage is above today’s fixed or variable rates, refinancing could save you thousands.

Here is why Economic Growth Slows in April, Widening Path for BoC Rate Cuts

Canada’s economy contracted by 0.1% in April, falling short of expectations and increasing the likelihood that the Bank of Canada could lower interest rates further this year.

GDP Slips as Manufacturing Struggles

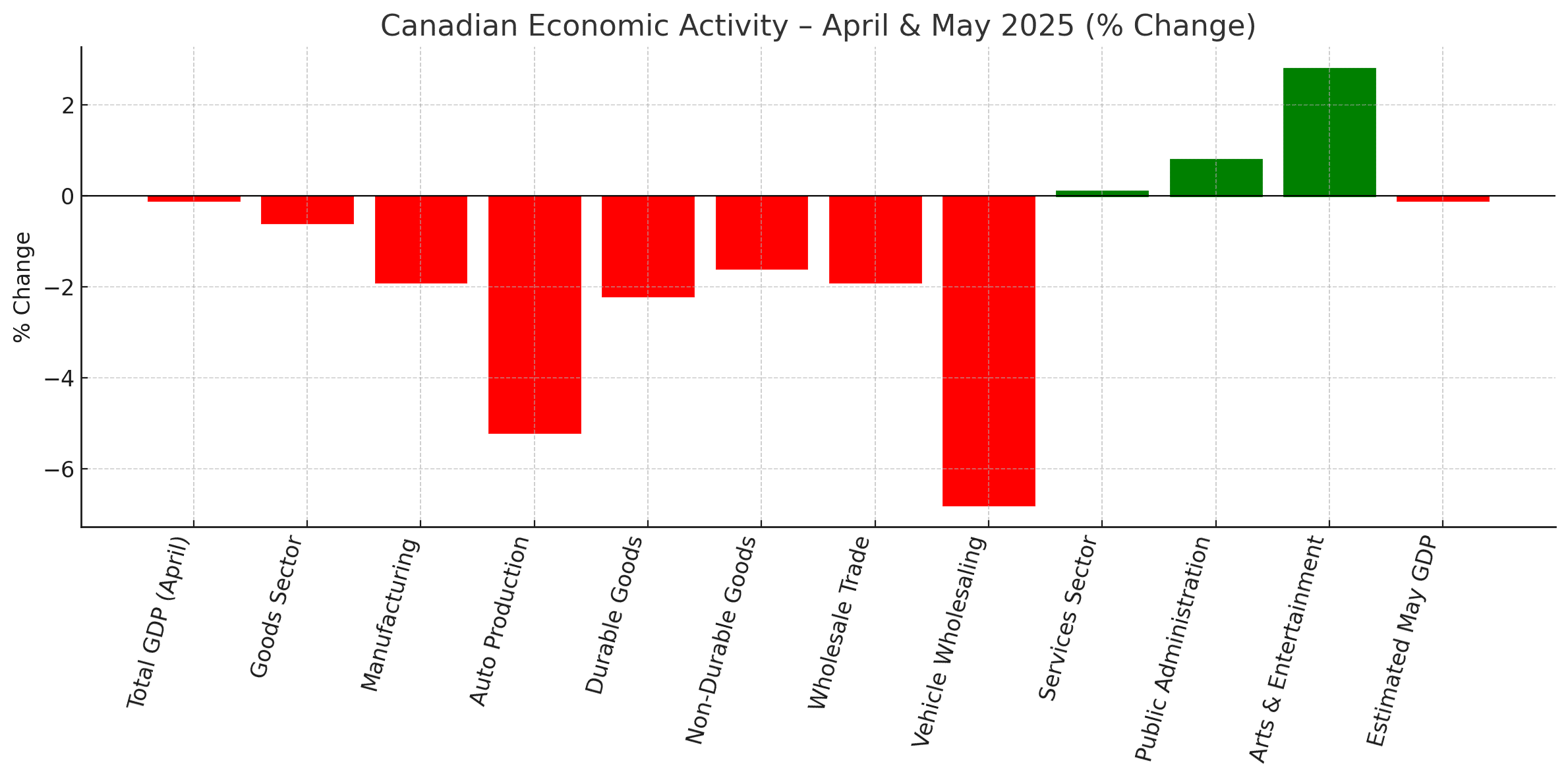

The goods-producing sector bore the brunt of the downturn, posting a 0.6% decline — the steepest since early 2024. Manufacturing activity fell 1.9%, dragged down by a 5.2% drop in auto production. Durable goods output dropped 2.2%, while declines in food and petroleum pulled non-durables down 1.6%.

Wholesale trade also took a hit, down 1.9%, with vehicle-related categories seeing the sharpest drops. CIBC’s Andrew Grantham warned that continued tariff uncertainty and operational cutbacks in certain industries may lead to more softness ahead.

Services Provide Minimal Offset

On the services side, the sector inched up 0.1%, helped by temporary boosts. A 0.8% gain in public administration—linked to the spring federal election—and a 2.8% jump in arts and entertainment, supported by strong NHL playoff attendance, helped prevent a larger decline.

Without those boosts, April GDP would have fallen closer to 0.2%, according to BMO’s Douglas Porter, who called it “a month of high drama.”

May Outlook Weak, Q2 Growth Likely Flat

Statistics Canada’s early read on May shows another 0.1% drop in economic output, with weakness in mining, government services, and retail. While manufacturing wasn’t explicitly mentioned, indicators like factory shipments and wholesale trends suggest continued headwinds.

TD’s Marc Ercolao pointed to intensifying risks: “Tariff pressures and eroding consumer confidence are starting to weigh more heavily on growth.”

Bank of Canada May Have Room to Move

With second-quarter GDP now expected to shrink between 0.3% and 0.5%, the economy is trending below the BoC’s base forecast but still above its worst-case projection.

While the data isn’t upbeat, economists say it strengthens the case for another interest rate cut. “We believe the central bank can ease policy two more times this year,” said Ercolao. However, inflation and labor data in the coming weeks will be critical ahead of July’s rate decision.

Market expectations for a July cut have increased slightly in response to April’s GDP miss, and bond yields have moved modestly lower as a result.

Each Office is Independently Owned & Operated • Brokerage 13072 | © Copyright 2024 . All Rights Reserved