Financial Stability Report—2025: Variable Mortgages vs. Fixed Mortgages

Signs of Financial Stress Remain Concentrated Among Non-Mortgage Households

The 2025 Financial Stability Report highlights a growing divide in financial resilience among Canadian households. Notably, financial stress is rising—but it’s not where you might expect. Households without a mortgage are currently exhibiting more signs of financial strain than their mortgage-holding counterparts.

Since the last report, arrears on credit cards and auto loans have increased significantly for households without a mortgage. After reaching historically low levels during the pandemic, these arrears have now surpassed their long-term averages, pointing to tightening financial conditions and possibly a waning buffer of savings built up during COVID-19.

Meanwhile, households with mortgages are faring slightly better. Though consumer credit arrears have also increased in this group over the past year, they remain below historical averages. This suggests that mortgage holders, at least for now, retain a greater degree of financial stability.

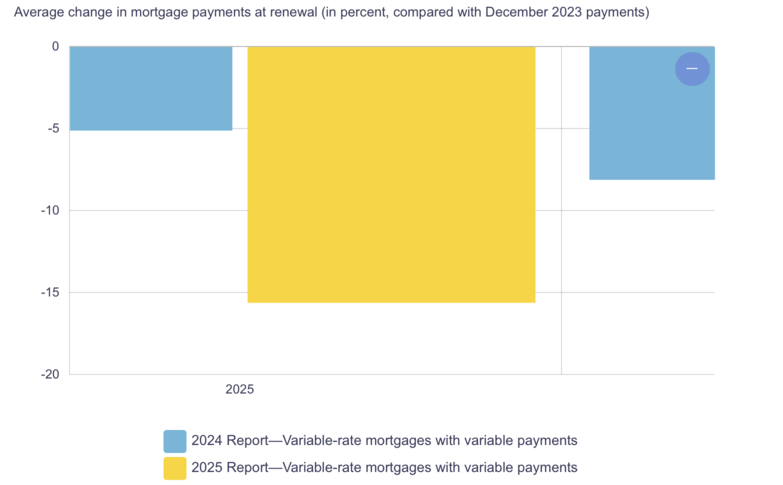

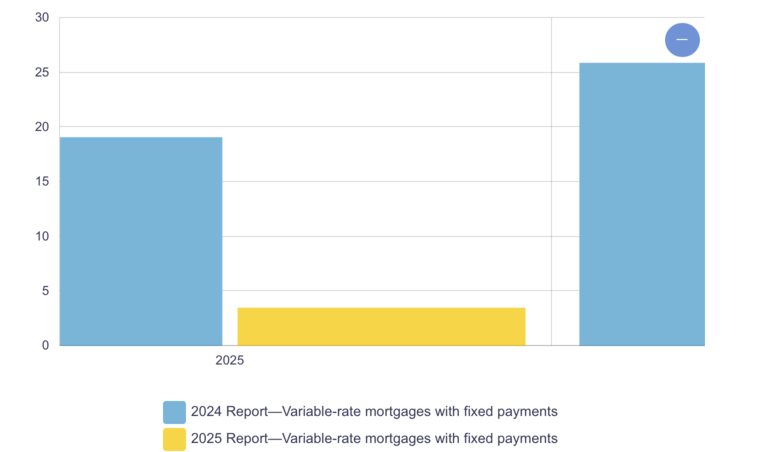

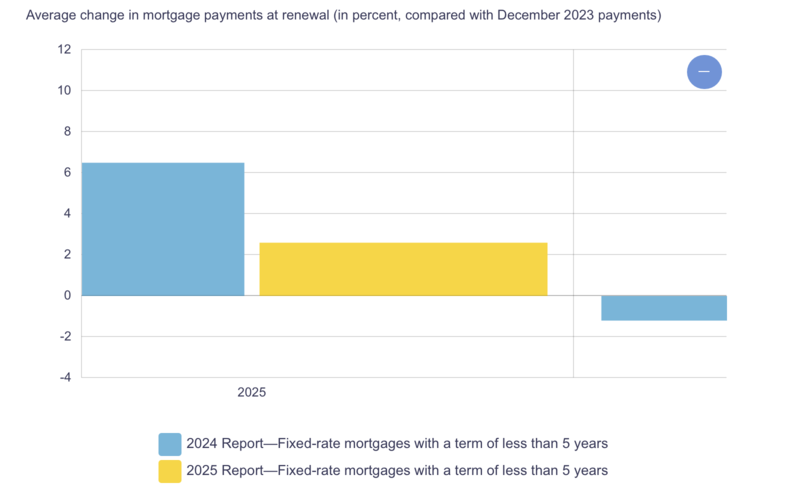

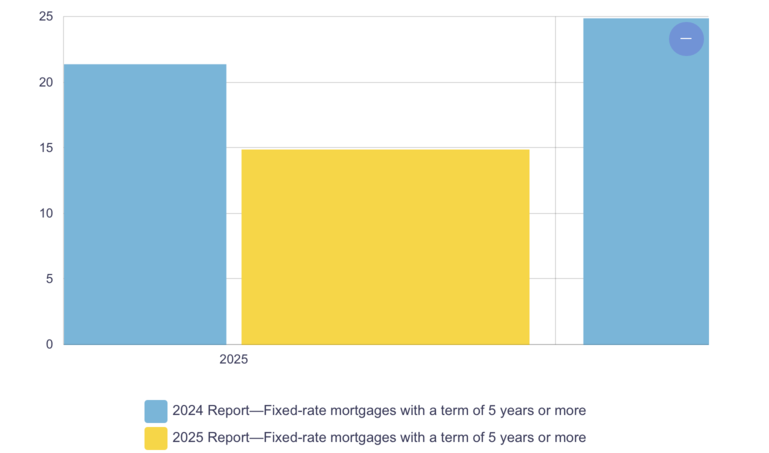

About 60% of all outstanding mortgages in Canada will renew in 2025 or 2026. Based on current market expectations for interest rates, approximately 60% of mortgages in this group will see an increase in their payments at renewal. Most of the mortgages expected to see an increase in payments at renewal are five-year fixed-rate mortgages that were originated or renewed during the pandemic at record-low interest rates. However, given the sharp decline in interest rates over the past year, the average expected increase will be smaller than what market expectations for interest rates a year ago suggested

Lower Interest Rates Provide Breathing Room for Mortgage Holders

Relief may be on the horizon for many Canadian homeowners. About 60% of all outstanding mortgages are due for renewal in 2025 or 2026. For a majority of these borrowers—especially those who locked in fixed-rate mortgages during the pandemic—renewal will likely come with higher payments. However, there’s a silver lining.

Thanks to a sharp decline in interest rates over the past year, the average increase in mortgage payments upon renewal is expected to be less severe than previously projected. Many homeowners who feared a significant spike in monthly costs may find themselves facing more manageable adjustments.

This is especially relevant for fixed-rate borrowers, who represent the bulk of upcoming renewals. These mortgages, often five-year terms secured during the ultra-low rate environment of 2020–2021, are now maturing into a higher-rate environment. But recent rate cuts have softened the blow, creating a more favorable outlook than anticipated just a year ago.

Variable rate mortgage with variable payments

Variable rate mortgage with fixed payments

Fixed-rate mortgages with a term of less than 5 years

Fixed rate mortgages with a term 5 Years or more

Variable vs. Fixed Mortgages: A Shifting Dynamic

The evolving interest rate landscape is reshaping the debate between variable and fixed mortgage options. Fixed-rate holders who previously benefited from low pandemic-era rates are now encountering renewal shocks, albeit more muted due to recent market movements. On the other hand, variable-rate borrowers, who faced immediate cost increases as rates climbed post-pandemic, are now positioned to benefit first from any further rate cuts.

As we move further into 2025, the question isn’t just which mortgage type is better—it’s how flexible borrowers can be in adapting to a changing financial environment. Whether fixed or variable, the key may lie in proactive financial planning and the ability to weather moderate changes in monthly obligations.

Financial report from Bank of Canada

Ready to Renew your mortgage? Let’s Talk.

Contact us today to discuss how you can take advantage of current market conditions and renew your mortgage with confidence—and potentially at a much lower rate.

Each Office is Independently Owned & Operated • Brokerage 13072 | © Copyright 2024 . All Rights Reserved