High interest Mortgage rate and low property value vs. Low Interest Mortgage rates and high property value.

Explore the key differences between mortgages with high interest and low property value versus those with lower interest rates and high property value. This guide dives into how these factors influence monthly payments, total interest costs, and overall affordability. Whether you’re considering an affordable property with higher interest or a premium property with lower rates, understanding these scenarios will help you make informed financial decisions.

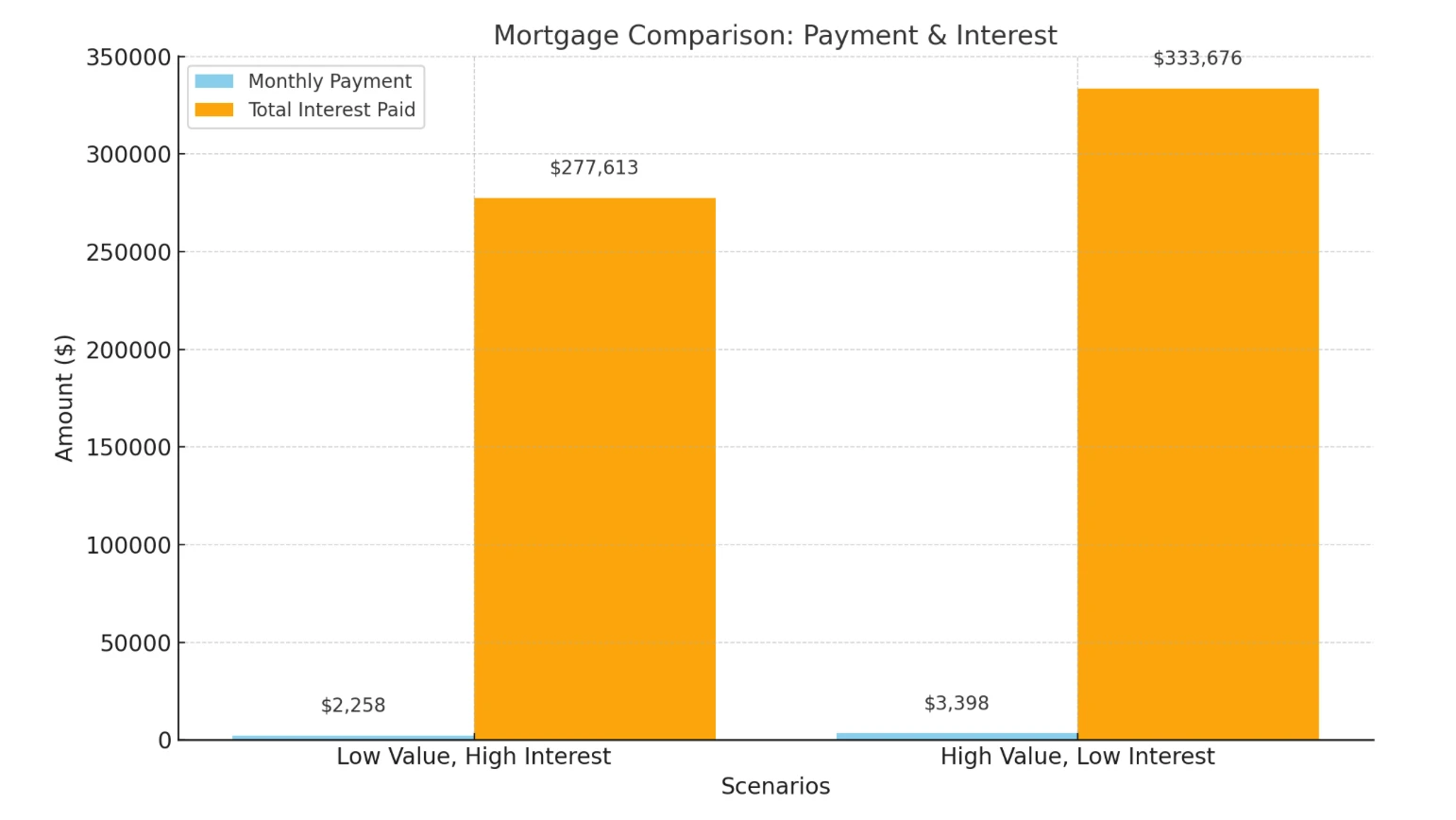

Scenario 1: Low Property Value, High Interest Rate

- Property Value: $500,000

- Down Payment: 20% ($100,000)

- Loan Amount: $400,000

- Interest Rate: 4.68%

- Amortization Period: 25 years

Monthly Mortgage Payment:

Approx. $2,258.71

Total Interest Over 25 Years:

Approx. $277,613

Scenario 2: High Property Value, Low Interest Rate

- Property Value: $850,000

- Down Payment: 20% ($170,000)

- Loan Amount: $680,000

- Interest Rate: 3.50%

- Amortization Period: 25 years

Monthly Mortgage Payment:

Approx. $3,398.92

Total Interest Over 25 Years:

Approx. $333,676

Key Comparisons:

- Monthly Payments:

- Higher property value and lower interest rate lead to higher monthly payments due to the larger loan amount.

- Total Interest:

- The total interest is higher in Scenario 2, but the lower rate offsets some of the higher borrowing costs.

- Affordability:

- Scenario 1 has lower monthly payments but higher interest rates over time, which may appeal to buyers with budget constraints.

Each Office is Independently Owned & Operated • Brokerage 13072 | © Copyright 2024 . All Rights Reserved