Real Residential Property Prices in Canada: Are We Headed Lower or Higher?

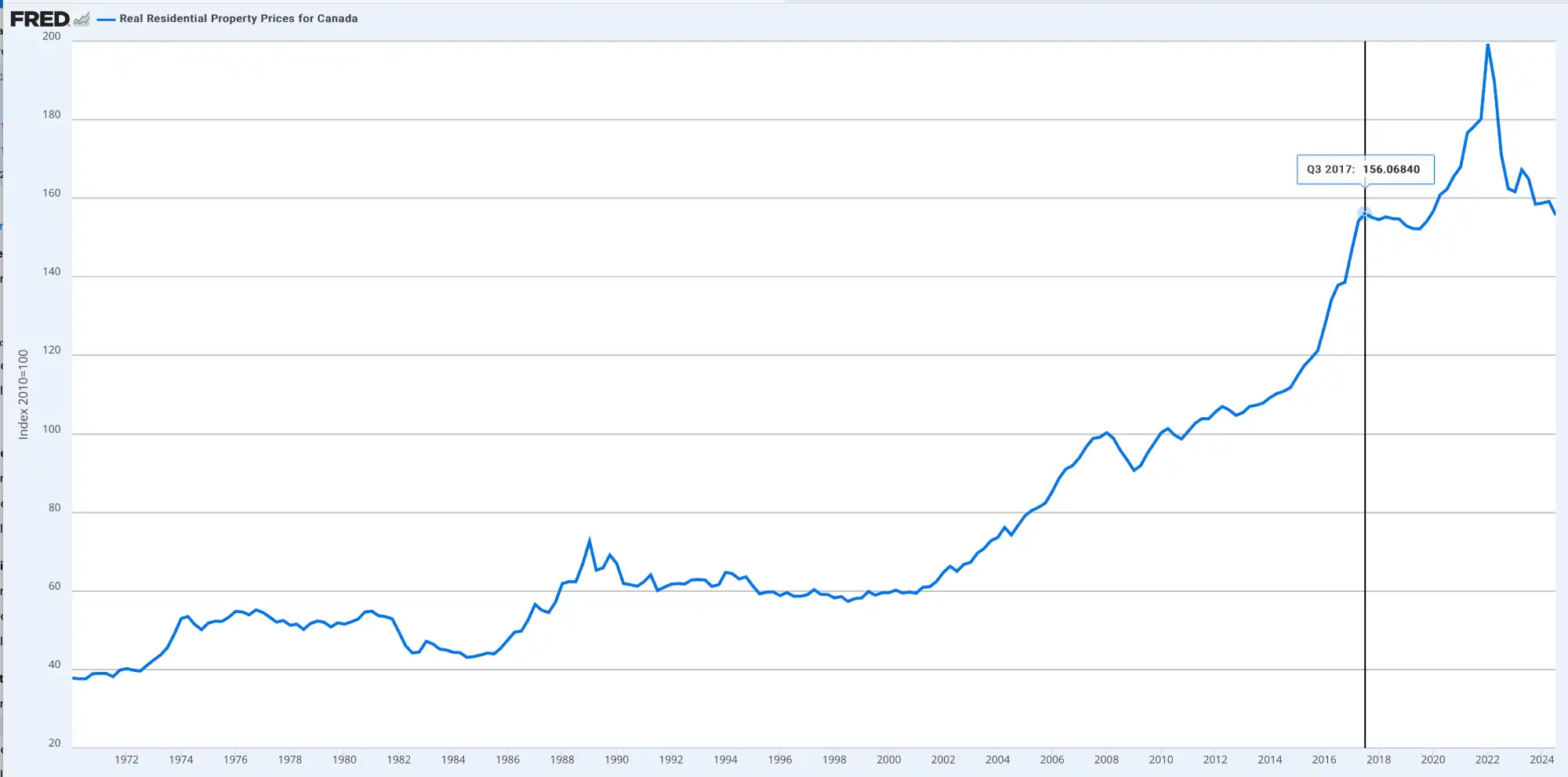

The Canadian real estate market has seen significant shifts over the past decade, with fluctuating property values driven by economic conditions, interest rates, and government policies. As of 2024, residential property prices have returned to levels seen between 2017 and 2019, sparking discussions on whether the market is poised for a rebound or further decline.

Current Market Trends

After peaking in 2022, property prices across major Canadian cities have adjusted to reflect changing economic factors. Higher interest rates introduced by the Bank of Canada to combat inflation led to reduced affordability, slowing demand and contributing to price corrections. However, despite these declines, the market remains relatively resilient, with price levels aligning with those observed in the late 2010s.

Factors Influencing Property Prices

Interest Rates and Mortgage AffordabilityThe Bank of Canada’s rate hikes have made borrowing more expensive, limiting buyers’ purchasing power. As a result, many potential homeowners have been priced out, leading to a cooling effect on housing prices.

Supply and Demand ImbalanceWhile prices have corrected, Canada continues to face a housing shortage, particularly in high-demand cities like Toronto and Vancouver. The limited availability of new homes may prevent significant price drops.

Economic Growth and InflationEconomic conditions play a crucial role in determining real estate trends. If inflation stabilizes and economic growth picks up, confidence in the housing market could return, pushing prices higher.

Government Policies and ImmigrationGovernment regulations, such as foreign buyer bans and increased housing supply initiatives, will shape market trends. Additionally, Canada’s high immigration targets continue to fuel housing demand, especially in urban centers.

Will Property Prices Go Lower or Higher?

Potential for Decline

If economic uncertainty persists and interest rates remain elevated, property prices could see further declines. Many homeowners who purchased at peak prices may be forced to sell due to higher mortgage costs, increasing housing inventory and placing downward pressure on prices.

Potential for Recovery

On the other hand, if inflation cools and interest rates start to ease, affordability may improve, leading to renewed buyer interest. Additionally, continued population growth and housing shortages could drive prices back up in the long term.

Conclusion

The Canadian real estate market is at a crossroads, with prices stabilizing at 2017-2019 levels. While short-term trends indicate a cooling phase, long-term factors such as population growth, housing shortages, and policy changes will play a critical role in shaping future property values. Investors and homebuyers should closely monitor economic indicators and market trends to make informed decisions on whether to buy, sell, or hold in this evolving landscape.

Each Office is Independently Owned & Operated • Brokerage 13072 | © Copyright 2024 . All Rights Reserved