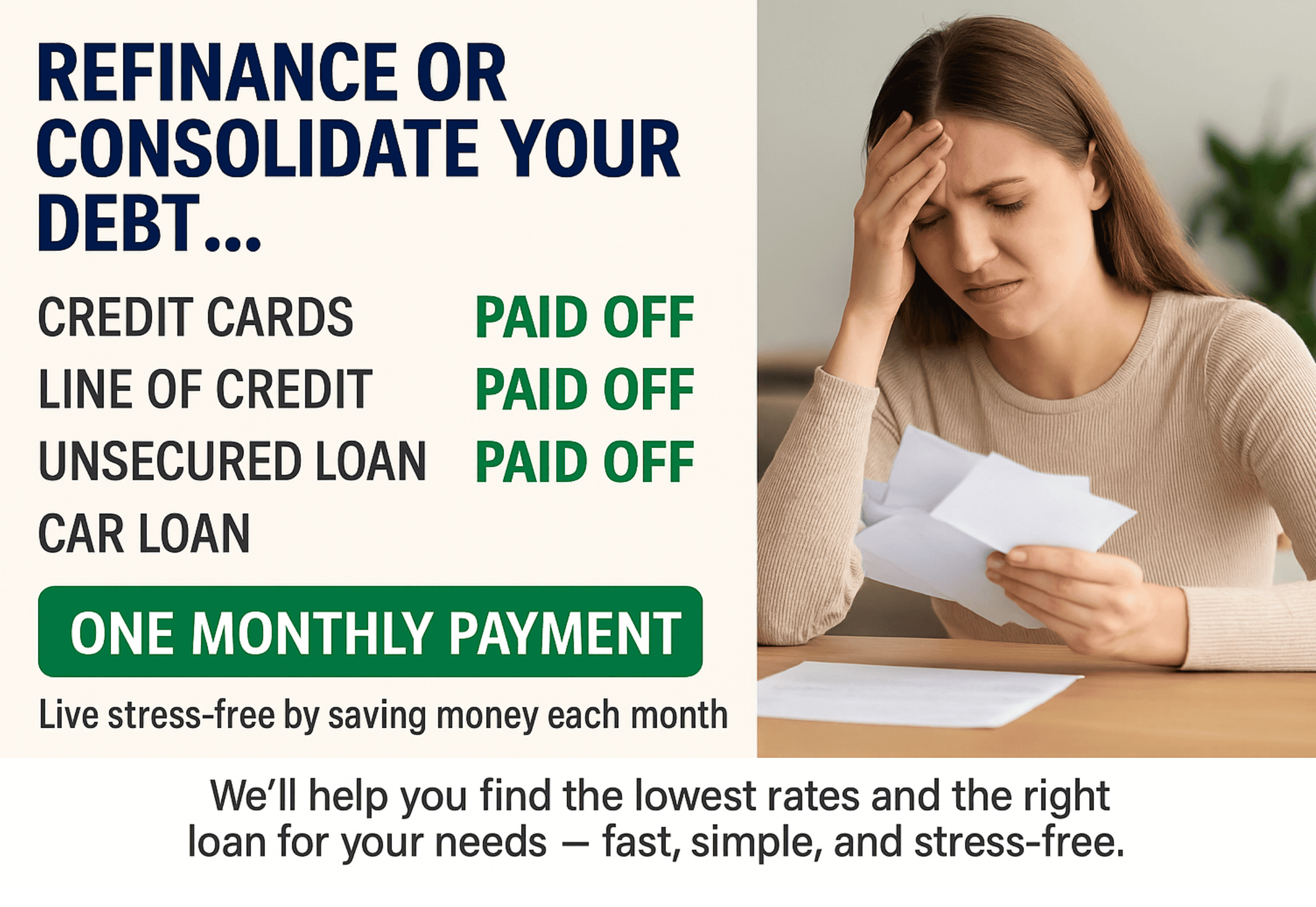

Refinance or Consolidate Your Debt: One Monthly Payment, Zero Stress

If you’re like many Canadians right now, rising interest rates and monthly bills may have you feeling stretched thin. Between credit cards, lines of credit, unsecured loans, and car payments, it can feel like your entire paycheck is gone before the month even starts.

The good news? There’s a way to simplify your finances, save money every month, and finally breathe easier — it’s called refinancing or debt consolidation.

What is Debt Consolidation Through a Mortgage Refinance?

Debt consolidation means rolling all your high-interest debts into one low-interest loan — often your mortgage.

Instead of paying multiple lenders at rates of 19% or more (common with credit cards), you make one monthly payment at today’s competitive mortgage rates.

For example:

Before Consolidation:

Credit Card 1: $8,000 at 19% interest

Credit Card 2: $5,000 at 21% interest

Line of Credit: $15,000 at 9% interest

Car Loan: $18,000 at 8% interest

After Consolidation:

One mortgage payment at ~4–5% interest

All other debts: PAID OFF

The Benefits of Refinancing to Consolidate Debt

Lower Interest Rates – You could cut your interest rate by more than half.

One Payment – No more juggling due dates or missing payments.

Lower Monthly Payments – Free up cash flow for savings, investments, or emergencies.

Improved Credit Score – Paying off multiple debts in full can boost your credit rating.

Less Stress – Fewer bills = less anxiety.

Who Can Benefit?

You may want to explore this option if:

You have multiple debts with high interest rates.

You own a home and have built up equity.

You want to free up hundreds of dollars each month in cash flow.

You’re tired of the financial juggling act and want peace of mind.

Real-Life Example

Before: Maria was paying $1,800/month across four debts.

After: By consolidating through a refinance, her payment dropped to $1,050/month — saving her $750 every month and wiping out all her high-interest accounts.

How to Get Started

Refinancing and consolidating debt isn’t a one-size-fits-all solution — but for many homeowners, it’s the smartest move they can make in today’s economy.

If you’re ready to:

✅ Lower your monthly bills

✅ Pay off all your debts

✅ Start living stress-free

Contact us today for a free, no-obligation consultation. We’ll help you find the lowest rate and the right loan for your needs — fast, simple, and stress-free.

Each Office is Independently Owned & Operated • Brokerage 13072 | © Copyright 2024 . All Rights Reserved