Still Afraid to Buy a Home? Here’s Why Your Mortgage Is a Wealth-Building Tool

Are you feeling stressed or hesitant about jumping into the real estate market? You’re not alone. With high home prices, rising interest rates, and economic uncertainty, it’s easy to feel overwhelmed. But sometimes, the best way to understand the power of real estate is to look back in time.

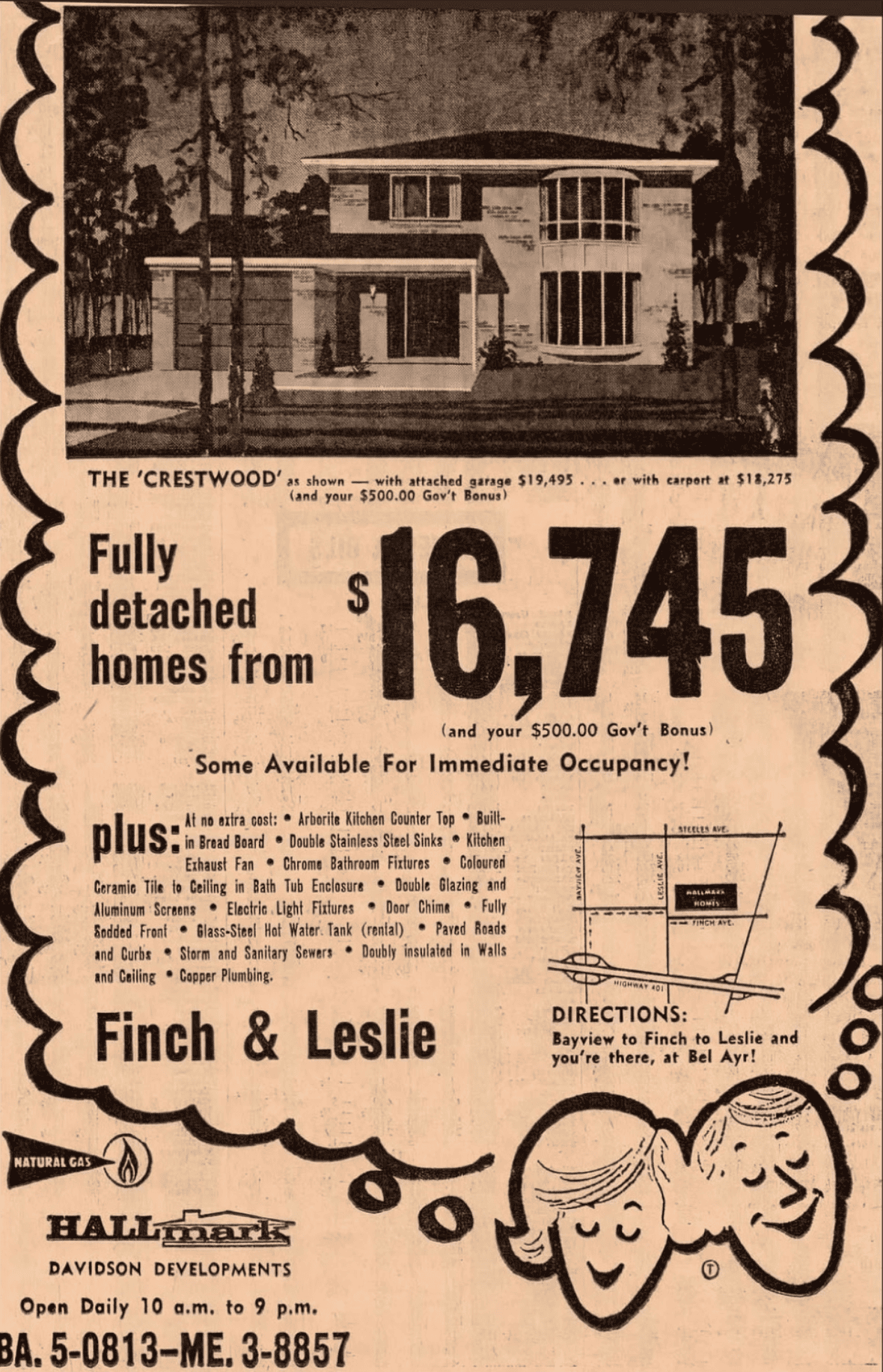

Take a look at this vintage real estate ad from the Finch & Leslie area in Toronto. It offers fully detached homes starting at just $16,745 — with an optional garage bumping it up to a “hefty” $19,495. Can you imagine? Today, the same area easily commands home prices well over $1.5 million.

If someone told their younger self to invest in real estate back then, they’d be laughing now — all the way to the bank. And guess what? Ten years from now, you could be in that exact same position.

Here’s the truth:

Real estate appreciates – Time and again, it’s proven to be one of the most reliable long-term investments.

Market timing is impossible – Waiting for the “perfect” time often leads to missed opportunities.

Your future self will thank you – The earlier you start, the more wealth you build over time.

Why buying now — even with a mortgage — is smart:

It’s important to purchase at a lower cost before the next price run begins. Real estate cycles always reward those who buy early. While you may be focused on current interest rates, remember this:

Paying interest is simply a tool to increase your buying power and build wealth.

A mortgage isn’t just debt — it’s leverage. It allows you to control a large asset with a smaller initial investment. Over time, your property appreciates, your equity grows, and that interest you once stressed over becomes a small price for future gains.

Bottom line:

The fear is real, but the reward is greater. Yes, today’s home prices are higher. But so are incomes, opportunities, and tools to help you qualify. Whether you’re a first-time buyer or investor, sitting on the sidelines too long may end up costing you far more than acting now.

Remember: They laughed at $16,745 homes once, too.

If you’re still unsure, let’s talk about your options. Whether it’s your first home, a refinance, or planning an investment strategy, I can help you move forward with clarity and confidence.

Each Office is Independently Owned & Operated • Brokerage 13072 | © Copyright 2024 . All Rights Reserved