Will Fixed Rates Fall in September?

What drives fixed rates

1. Bond Yields:

* Fixed rates follow 5-year bond yields closely.

* If yields drop, lenders lower fixed rates. If yields rise, fixed rates climb.

2. Bank of Canada Policy:

* The BoC doesn’t set fixed rates, but its tone on inflation and growth influences bond yields.

* A bigger-than-expected rate cut → yields fall → fixed rates likely drop.

* If BoC signals slower easing (worried about inflation) → yields steady or rise → fixed rates could hold or climb.

3. Inflation Data (CPI mid-September):

* A softer CPI = more confidence in cuts → fixed rates come down.

* A surprise rebound = yields up → fixed rates rise.

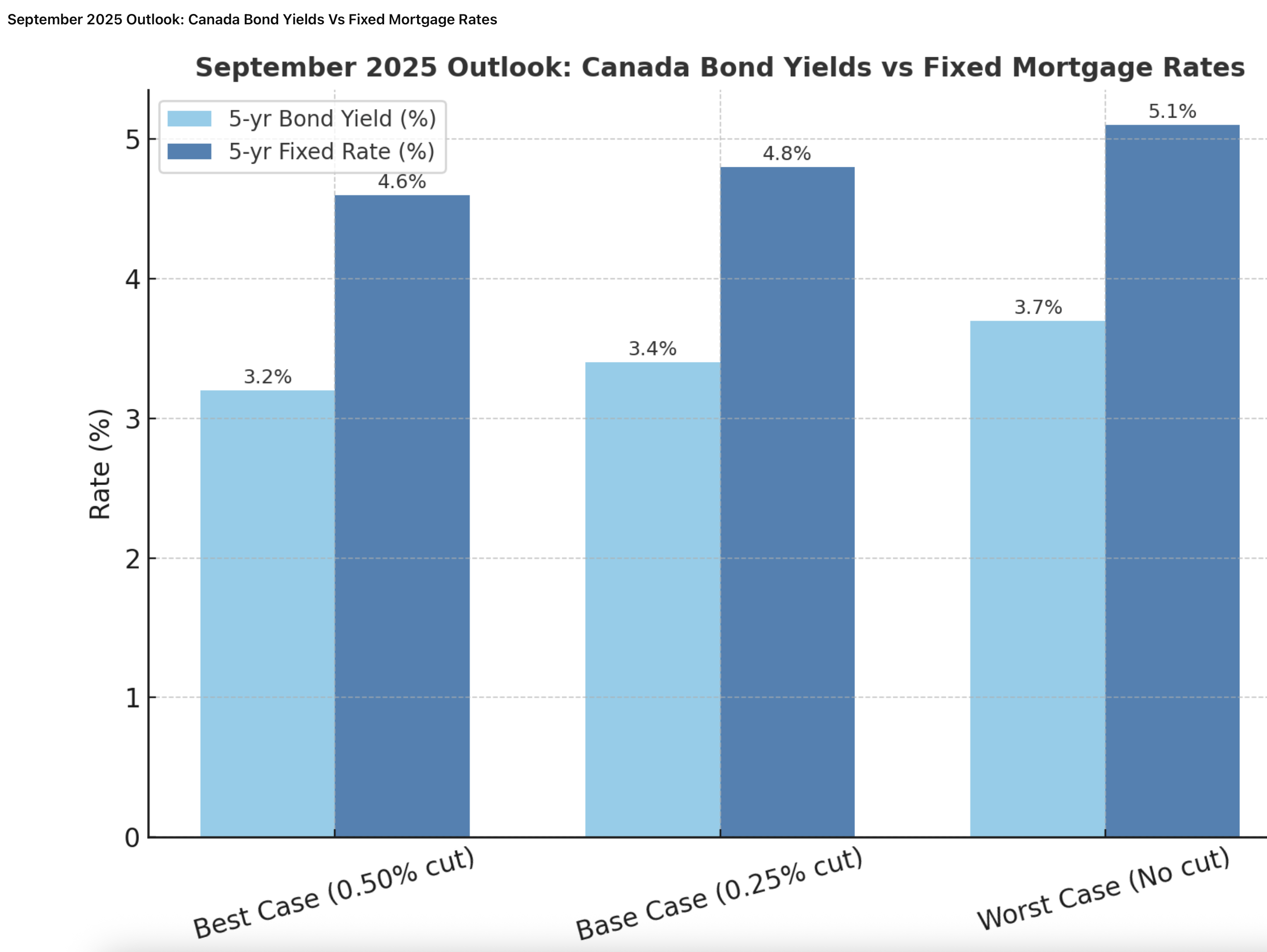

September 2025 Outlook

* GDP is weak (1.6%) and unemployment is higher (≈7%), which leans toward lower yields.

* Inflation is still above target, so BoC may not rush into aggressive cuts.

* Bond market is already pricing in at least one rate cut this fall.

Most likely:

* Fixed rates could edge down slightly in September if bond yields ease further on weak data.

* If inflation comes in hot mid-month, expect a temporary bump up in fixed rates.

Quick Scenarios

* BoC cuts 0.25% in Sept + soft inflation → 5-yr fixed rates fall ~0.10–0.25%.

* No cut in Sept, inflation sticky → fixed rates hold steady or creep up.

* Surprise 0.50% cut (unlikely, but possible if economy weakens fast) → fixed rates drop more aggressively.

Each Office is Independently Owned & Operated • Brokerage 13072 | © Copyright 2024 . All Rights Reserved